(Bloomberg Opinion) -- Although the U.S. government said the economy expanded at a faster-than-expected rate of 2.6 percent last quarter, there’s little doubt that activity has slowed considerably this year. Market participants should prepare themselves for an environment going forward where growth in any one quarter might be negative in the next even if the economy avoids recession.

The Federal Reserve Bank of Atlanta’s initial estimate of first quarter 2019 growth is a meager 0.3 percent. That kind of number will generate plenty of recession warnings. Moreover, it doesn’t take much imagination to push that estimate below zero. But would a weak first quarter number signal a recession is underway, or even close at hand?

Not so fast. First, note that the first quarter has been the weakest quarter in four of the past five years and six of the past nine years. This suggests there remain some residual seasonal effects in the data that weigh down growth numbers early in the year. That alone should make us cautious in how we interpret the first-quarter results.

A second and more general point is that lower trend growth and a higher variability of growth around that trend means there is a higher probability of negative growth readings outside of recessions. Indeed, this expansion has already experienced three quarters of negative growth in the first and third quarters of 2011 and the first quarter of 2014.

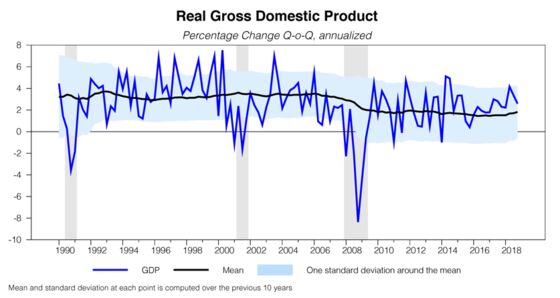

To illustrate this point, first examine the mean and standard deviation of GDP growth over 10-year windows (where the statistics are calculated from the past 10 years of data). Two points should jump out.

First, as the volatility of the 1970s and early 1980s moved further into the past, the variance of GDP growth narrows as illustrated by the one standard deviation band around the mean. In the wake of the Great Recession, that one standard deviation band is wider.

Second, mean growth is lower, currently 1.8 percent over the past 10 years, compared with the roughly 3.5 percent recorded at the beginning of the 2000s. The combination of more variability around lower trend growth means that a one standard deviation band captures negative GDP growth. In other words, a negative GDP report would no longer fall outside the normal range of quarterly growth, whereas that wasn’t the case for the roughly two-decade period prior to the Great Recession.

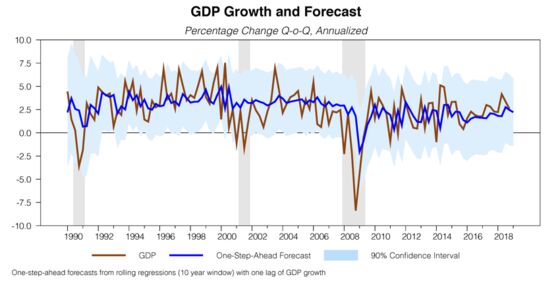

To illustrate this point further, consider a simple model of GDP growth based on a constant and one lag of growth (formally known as an AR(1) model). The 90 percent confidence intervals around the one-step ahead forecasts now regularly capture sizable negative GDP growth outcomes. Compare that to the previous two decades of relative stability at higher growth rates.

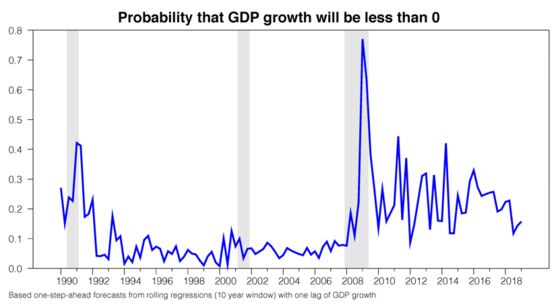

Going another step further, I calculated the probability at each forecast that the actual outcome for GDP growth is less than zero. Between the 1990 recession and the Great Recession, that probability was generally between 0 and 10 percent. Since the Great Recession, that probability has ranged between 10 and 40 percent.

Notice that the probability of a negative outcome is now at the lower end of the range. The past few years have seen fairly stable growth on the back of the manufacturing recovery and fiscal stimulus. I suspect that with both those factors fading, growth will again become more variable going forward.

What’s the takeaway here for markets? We should expect that GDP growth in any given quarter might be negative outside of a recession. Be especially cautious about claims the economy has hit a “stall speed,” or a low growth level at which a recession is guaranteed. Any estimates of such a stall speed from the past will be too high for the current era of lower trend growth.

We shouldn’t place too much weight on any given quarterly GDP number and should instead remember to analyze the economy in the context of the entire constellation of data.

To contact the editor responsible for this story: Robert Burgess at bburgess@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Duy is a professor of practice and senior director of the Oregon Economic Forum at the University of Oregon and the author of Tim Duy's Fed Watch.

©2019 Bloomberg L.P.