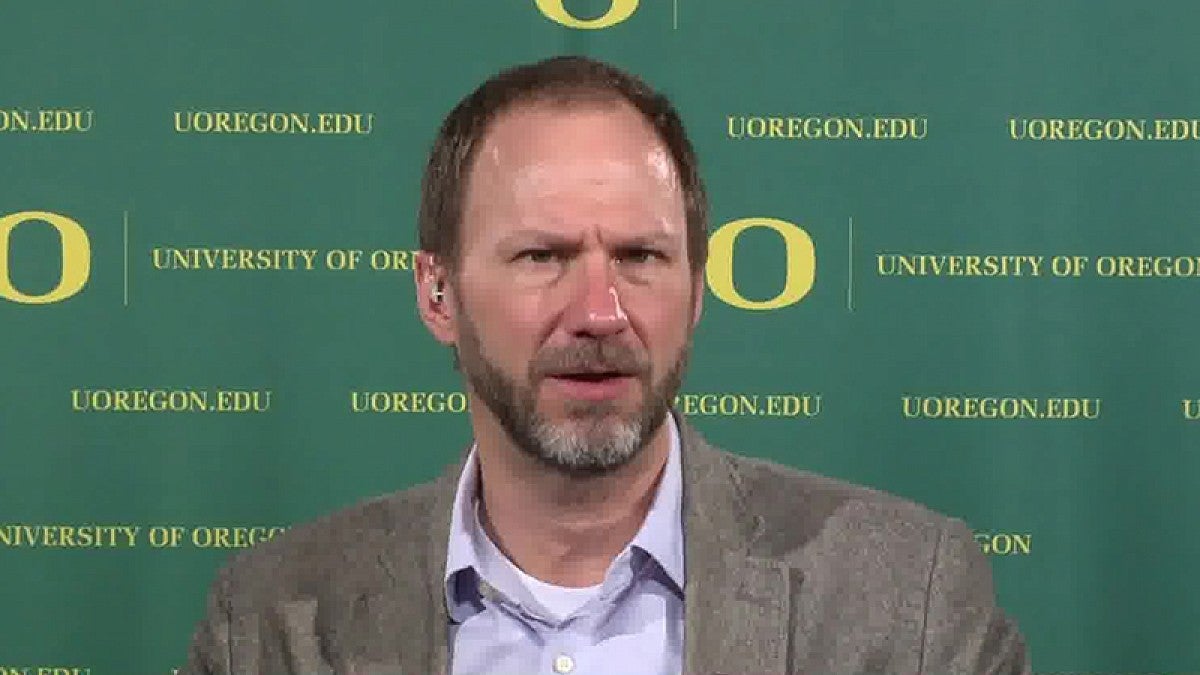

The U.S. Federal Reserve lacks the data it needs to justify an interest rate hike this month, UO economist Tim Duy writes in a recent article for Bloomberg Markets.

Duy explains why it’s unlikely any policy changes to the federal funds rate will happen before September.

He outlines a recent speech made by Federal Reserve Chair Janet Yellen, indicating her comments “tells us that the Fed is ready and willing to hike rates. But that pesky little detail of a consistent data narrative to justify such a move continues to elude policymakers.”

While some second-quarter numbers point to economic growth after a dismal first quarter, mixed employment numbers in May caused the Federal Open Market Committee to rethink a June rate hike.

“The lack of supportive data has stripped them of a chance to hike rates in June, and also leaves July as an unlikely candidate. Turn your eyes to September,” Duy said.

For Duy’s full piece, see “Not June, Not Likely July, More Likely September” on Bloomberg Markets.